Delisting from CEXs and Listing on DEXs at $0.15 (Jan 2025): The Layer One X (L1X) Coin Listing Strategy

This Initial Draft will be analysed and discussed in the upcoming webinar on 03/12/2024 including the rationale, marketing plan to push demand on DeX’s and other key associated points. The analysis and discussion will cover price stability mechanism, demand-generating aspects and timelines on expected liquidity compared with token release and pool performance.

This document outlines the Why and the plan for Layer One X (L1X) to delist from centralized exchanges (CeX) and transition to decentralized exchanges (DeX), utilizing innovative strategies for price stabilization, liquidity growth, and Coin supply control.

WHY?

Delisting and Relisting: A Strategic Move for Layer One X

The decision to delist Layer One X from centralized exchanges and relist on decentralized exchanges (DEXs) is a strategic move that significantly benefits the project and our community. By understanding the advantages of this approach, we can gain insights into the future of blockchain technology and the evolution of digital assets.

Understanding the Core Concept

Layer One X (L1X), is designed to revolutionize the way we interact with digital assets. By transitioning from centralized to decentralized exchanges, L1X aims to enhance security, privacy, and user autonomy.

The Benefits of Delisting and Relisting

Delisting a cryptocurrency from centralized exchanges and relisting it on DEXs can offer a multitude of advantages:

Enhanced Decentralization

- Reduced reliance on Intermediaries: By shifting to DEXs, L1X will minimize its dependence on centralized entities, thereby reducing the risk of censorship, manipulation, and potential shutdowns.

- Empowered Users: DEXs empower users by granting them direct control over their assets and transactions. This eliminates the need for intermediaries, fostering a more transparent and democratic ecosystem.

Enhanced Security

- Mitigating the Risk of Hacks: DEXs, being decentralized, are inherently more resistant to cyberattacks and security breaches that often plague centralized exchanges.

- Improved Privacy: DEXs prioritize user privacy by employing decentralized protocols that obscure user identities, safeguarding sensitive information.

Increased Accessibility

- Global Reach: DEXs operate on a global scale, making L1X accessible to users worldwide, regardless of geographic location or regulatory hurdles.

- Lower Barriers to Entry: DEXs often have lower fees and simpler onboarding processes, making it easier for individuals to participate in the L1X ecosystem.

Fostering Innovation and Flexibility - A Core L1X Capability

- Rapid Development: DEXs are agile and adaptable, enabling L1X to quickly respond to technological advancements and market trends.

- Customizable Trading Experiences: DEXs offer a diverse range of trading options and features, allowing users to tailor their experiences to their specific preferences and risk tolerances.

Community-Driven Governance

- Transparent Decision-Making: Many DEXs are governed by decentralized autonomous organizations (DAOs), empowering the community to participate in decision-making processes.

- Shared Ownership: DEXs often incorporate token-based governance models, enabling users to own a stake in the platform and influence its future direction.

Addressing Liquidity Concerns

A common concern regarding DEXs is liquidity, as they may not always match the trading volumes of centralized exchanges. However, several strategies can be employed to mitigate this issue:

- Incentivized Liquidity Programs: Implementing liquidity mining and staking rewards can attract liquidity providers to DEXs, encouraging active trading and market-making.

- Automated Market Makers (AMMs): AMMs, such as Uniswap Pancake Swap and SushiSwap, provide continuous liquidity by allowing users to trade directly with a liquidity pool.

- Strategic Partnerships: Collaborating with other projects and protocols can help increase the visibility and adoption of L1X, attracting more users and liquidity.

L1X can successfully transition to a decentralized exchange model, further unlocking L1X's full potential and driving blockchain innovation.

Key Elements of the Plan

- Delisting from CEXs: Layer One X plans to delist from centralized exchanges (e.g., Bitmart, LBank, MEXC) due to challenges such as Pricing on the CEXs have dropped significantly (to $0.008). High Coin supply from rewards and bonuses leading to speculative activity.

- Switching to DEX Listings: Plan to list on: Uniswap: L1X/ETH pair for the Ethereum ecosystem. PancakeSwap: L1X/BNB pair for the Binance Smart Chain (BSC). Raydium: L1X/SOL pair for the Solana ecosystem.

- Utilizing L1X X-Talk for Interoperability: Cross-Chain System between the Layer One X blockchain and these ecosystems using the X-Talk feature to enable seamless Coin movement.

- Initial Pool Funding: Start with $50,000 worth of L1X coins and $50,000 worth of ETH, BNB, or SOL for each pool. The initial L1X price will be set at $0.15 in these pools. For January 2025 upon completion of the Rights Issue, there will be ~302 million L1X Coins which gives a valuation of ~$45 million which has enough 10x potential compared to the protocols such as Layer Zero and Axelar at ~$400 million and ~$600 million respectively.

- Coin Supply Control via Pool Dynamics: Coins from the L1X ecosystem (native L1X chain) will be sent cross-chain and released into DeX pools gradually based on pool performance and demand. Mechanisms will be implemented to maintain a price floor ($0.15) and stabilize liquidity.

Prioritization of Coin Holders (Investors)

The Coin release strategy includes prioritization of different categories of L1X coin holders:

- Category A (Rights Issue & XPerks): High-priority investors, including term-sheet/public/private sale buyers.

- Category B (Node Operators, Developers and Performance Airdrops): Medium-priority stakeholders.

- Category C (Non-XPerks & Bonus Holders): Low-priority participants, often rewarded at a $0 base.

Key Objectives

- Stabilize the L1X price and encourage organic growth on DEX platforms.

- Gradually grow liquidity pools to attract external participants.

- Shift control over Coin circulation and pricing to a more transparent, decentralized environment.

Coin Release Plan: Categories and User Weightage

This document outlines a phased Coin release strategy for Categories A, B, and C based on priority weightage and user allocation mechanisms. It ensures fairness by combining category-wise prioritization with user-level weightage and equal distribution.

1. Categories and Phased Release Plan

The Coin release plan is divided into three categories with priority-based sequential releases. The release phases will ensure high-priority categories have access to liquidity first, while gradually including lower-priority categories over time.

Category Definitions

|

Category |

Description |

Priority Level |

|

Category A |

Presale to DeX, Rights Issue, XPerks, and CEX Buyers |

High |

|

Category B |

Node Operators, Developers and Performance Airdrops |

Medium |

|

Category C |

Non-XPerks (Bonus Coins) |

Low |

Phased Release Plan

The phased release ensures sequential and proportionate Coin distribution over time:

|

Phase |

Time Period |

Category A (%) |

Category B (%) / Category C (%) |

|

Phase 1 |

0–2 Months |

100% |

0% / 0% |

|

Phase 2 |

3–12 Months |

70% |

30% / 0% |

|

Phase 3 |

12+ Months |

70% |

20% / 10% |

User Weightage and Allocation

Within each category, coins are allocated to users using a combination of weightage-based allocation (based on individual holdings) and equal distribution.

Equations for User Allocation

1. Weighted Allocation:

Weighted Allocation (User i) = (User i's Coins / Total Coins in Category) × Weighted Pool

2. Equal Distribution Allocation:

Equal Distribution (User i) = Equal Pool / Total Number of Users

3. Final Allocation:

Final Allocation (User i) = Weighted Allocation (User i) + Equal Distribution (User i)

Example Calculation

Assume the following scenario for Category A in Phase 2:

- Total Coins: 1,000

- Weighted Pool: 25% (250 coins)

- Equal Pool: 75% (750 coins)

Calculations (Example):

• Total Coins in Pool Released: 1,000 coins

• Weighted Pool: 250 coins (25%)

• Equal Pool: 750 coins (75%)

• User Holdings:

• User A: 100 coins

• User B: 200 coins

• User C: 25 coins

• User D: 40 coins

• Total User Holdings: 100 + 200 + 25 + 40 = 365 coins

Weighted Allocation:

Weighted allocation is proportional to the user’s holdings relative to the total holdings.

• User A: (100/365) times 250 = 68.49

• User B: (200/365) times 250 = 136.99

• User C: (25/365) times 250 = 17.12

• User D: (40/365) times 250 = 27.40

Equal Distribution Allocation:

The equal pool is divided equally among all users.

• Equal Pool: 750 coins

• Number of Users: 4

• Each User Gets: 750/4 = 187.50

Exhaustive Allocation:

Allocate coins from both the Weighted Pool and Equal Pool until each user’s total holdings are exhausted. Any excess remains as pending coins.

User A:

• Total Holdings: 100 coins

• Weighted Allocation: 68.49 coins

• Equal Distribution Allocation: Needs 31.51 more coins to exhaust their holdings.

• Total Allocation: 100 coins (exhausted)

• Pending Coins: 187.50 - 31.51 = 155.99 coins

User B:

• Total Holdings: 200 coins

• Weighted Allocation: 136.99 coins

• Equal Distribution Allocation: Needs 63.01 more coins to exhaust their holdings.

• Total Allocation: 200 coins (exhausted)

• Pending Coins: 187.50 - 63.01 = 124.49 coins

User C:

• Total Holdings: 25 coins

• Weighted Allocation: 17.12 coins

• Equal Distribution Allocation: Needs 7.88 more coins to exhaust their holdings.

• Total Allocation: 25 coins (exhausted)

• Pending Coins: 187.50 - 7.88 = 179.62 coins

User D:

• Total Holdings: 40 coins

• Weighted Allocation: 27.40 coins

• Equal Distribution Allocation: Needs 12.60 more coins to exhaust their holdings.

• Total Allocation: 40 coins (exhausted)

• Pending Coins: 187.50 - 12.60 = 174.90 coins

3. Fairness in Allocation

This approach promotes fairness by ensuring:

- High-priority categories have access to liquidity first.

- Large holders within a category receive a proportionally larger share (via weighted allocation).

- Smaller holders are not excluded, as equal distribution ensures they can exhaust their coins over time.

Dynamic Coin Release Algorithm

This section outlines the necessary parameters and equations for managing a dynamic Coin release algorithm that incorporates price floors, ceilings, liquidity, and pool performance to maintain price stability and encourage healthy trading activity.

“This strategy is designed to keep the L1X token price stable, protect against price crashes, and encourage a healthy market. By responding to trading activity, price changes, and liquidity, we ensure fair releases that benefit both long-term holders and new buyers.”

1. Pool Volume Contribution

Calculate the impact of pool trading volume on the Coin release:

Volume Contribution ensures that higher trading activity increases the release rate.

2. Price Change Contribution

Monitor the Coin’s price change to prevent releases during high volatility:

Price Change = (P_current - P_previous) / P_previous

If |Price Change| > Volatility Tolerance: Reduce or pause releases.

3. Liquidity Adjustment Factor

Adjust the release rate based on the pool’s liquidity depth:

Liquidity Adjustment Factor = Total Liquidity / Liquidity Threshold

Where Total Liquidity = USDC Reserve + (L1X Reserve × P_current).

This ensures Coin releases align with the pool’s capacity to handle them without destabilizing the price.

4. Net Buy/Sell Pressure

Measure whether the market is net-buying or net-selling L1X coins:

Net Buy Pressure = USDC Value Inflow - USDC Value Outflow

If Net Buy Pressure > 0: Increase Coin releases.

If Net Buy Pressure < 0: Reduce or pause Coin releases.

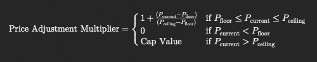

5. Price Adjustment Multiplier

Adjust the release rate based on how close the price is to the floor or ceiling:

Price Adjustment Multiplier =

1 + ((P_current - P_floor) / (P_ceiling - P_floor)) if P_floor ≤ P_current ≤ P_ceiling

0 if P_current < P_floor

Cap Value if P_current > P_ceiling

This prevents Coin releases if the price is too low and caps releases if the price is too high.

This ensures Coin releases align with the pool’s capacity to handle them without destabilizing the price.

6. Net Buy/Sell Pressure

Measure whether the market is net-buying or net-selling L1X coins:

Net Buy Pressure = USDC Inflow - USDC Outflow

If Net Buy Pressure > 0: Increase Coin releases.

If Net Buy Pressure < 0: Reduce or pause Coin releases.

7. Price Adjustment Multiplier

Adjust the release rate based on how close the price is to the floor or ceiling:

Price Adjustment Multiplier =

1 + ((P_current - P_floor) / (P_ceiling - P_floor)) if P_floor ≤ P_current ≤ P_ceiling

0 if P_current < P_floor

Cap Value if P_current > P_ceiling

This prevents Coin releases if the price is too low and caps releases if the price is too high.

6. Price Impact from Trades

Calculate the price change caused by trading activity:

Price Impact = Trade Size (USDC) / Liquidity Depth (USDC)

If price impact is significant, reduce or pause releases to prevent destabilizing the market.

7. Final Release Formula

Combine all the above factors to calculate the number of extra L1X coins to release into the pool:

Extra L1X Released = (Volume Contribution × Net Buy Pressure / P_current) × Liquidity Adjustment Factor × Price Adjustment Multiplier

Where:

Volume Contribution: Pool trading activity.

Net Buy Pressure: Market sentiment.

P_current: Current price of L1X.

Liquidity Adjustment Factor: Reflects pool capacity.

Price Adjustment Multiplier: Ensures price thresholds are respected.

Decision Rules

1. Price Below Floor: Halt Coin releases (Price Adjustment Multiplier = 0).

2. Price Above Ceiling: Cap Coin releases (Price Adjustment Multiplier = Cap Value).

3. High Volatility or Net Sell Pressure: Reduce or pause Coin releases.

4. Strong Demand and Liquidity: Increase Coin releases proportionally.

Process Flow

The current XPerks coin distribution and bonus rights for Public Sale buyers, who are being offered 1:4 bonus L1X Coins, will remain unchanged. The following points outline the proposed flow for the process:

• Staking into the L1X Pool Release Contract:

Users holding L1X Coins will have the option to stake their coins into the L1X Pool Release contract. These staked coins will remain locked until they are liquidated into decentralized exchanges (DeX). Once locked, the coins cannot be unlocked until they are sold on DeX platforms. The selling price will be determined by the performance of the pool.

• Optional Allocation by Coin Holders:

Coin holders can choose to allocate either a certain percentage of their holdings or their entire holdings into the pool. The decision is entirely at the discretion of the user.

• Reward Distribution in BSC USDT:

Users will be rewarded in BSC USDT based on the total L1X Coins sold and allocated to them. A dashboard will be provided to allow users to monitor their staked coins, their total weightage in the release schedule, and the amount of BSC USDT available for claiming.

• Dashboard and User Guide:

A detailed guide will be made available to users, explaining how to stake their coins, monitor statistics, and track the progress of sold coins. This guide will ensure a smooth user experience upon release.