The L1X ecosystem has been meticulously updated to foster sustainable growth and drive value for its token holders. At the heart of this strategy lies a carefully crafted fee structure to incentivize swaps, boost liquidity, and burn tokens, creating a virtuous cycle of increasing demand and creating value for the L1X Coin.

To date, less than 10% of the coins, approximately 62 million, have been distributed to investors. Since the token launch in May 2024, L1X has been making steady progress toward listing on major decentralized exchanges in Q1 2025, aiming to enhance price discovery. While the current listings on Tier 3 exchanges—BitMart, LBank, and MexC—have provided an initial liquidity setup, transitioning to larger platforms will increase user engagement and awareness, fostering stronger price discovery and market momentum.

The Virtuous Cycle in Action

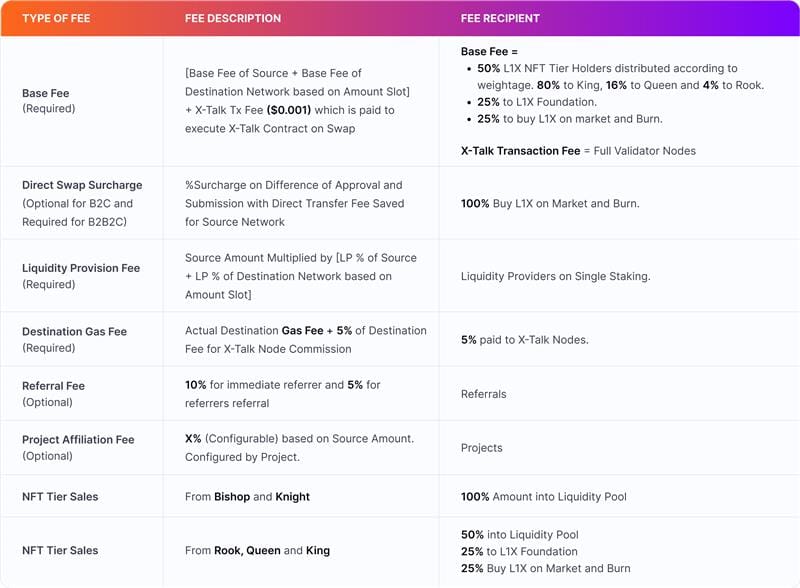

Each transaction within the L1X ecosystem contributes directly to the value appreciation of the token through a carefully aligned fee allocation model. Here’s how it works:

1. Base Fee: The Foundation of Value Creation

• The Base Fee, applicable on every swap, is split into key allocations that benefit the entire ecosystem:

• 50% is distributed to L1X NFT Tier Holders, creating a reward mechanism for the community based on NFT tier weightage (80% King, 16% Queen, 4% Rook). These NFT sales provide Liquidity for Swaps, rewarding holders with swap revenue, and earning extra points on every swap, which can then be swapped into L1X.

• 25% is allocated to the L1X Foundation, enabling ongoing development and expansion.

• 25% is used to buy L1X tokens from the market and burn them, reducing supply and driving scarcity.

2. Direct Swap Surcharge: Maximising Burn Potential

• For B2B2C use cases, an additional surcharge based on transfer fee savings is applied, with 100% of the collected surcharge being used to buy L1X tokens from the market and burn them. This creates a compounding effect, further reducing circulating supply and increasing token demand.

3. Liquidity Provision Fee: Supporting Swap Liquidity

• This fee ensures sufficient liquidity for seamless swaps by incentivizing Liquidity Providers with rewards, promoting active participation in staking pools. The stronger the liquidity, the more transactions the network can support, creating further value for the token.

4. NFT Tier Sales: Building Value for the Ecosystem

• Revenue generated from the sale of Bishops and Knights is 100% contributed towards Liquidity Provision.

• Revenue generated from the sale of NFT Tiers (Rook, Queen, and King) is a significant contributor to the burn mechanism:

• 25% of NFT Tier Sale revenue is used to buy and burn L1X tokens, tying network growth directly to token scarcity.

• 50% is allocated to the liquidity pool to enhance swap efficiency.

• 25% goes to the L1X Foundation for growth initiatives.

5. Destination Gas Fees and Referrals: Driving Network Engagement

• Destination Gas Fees include a 5% commission allocated to X-Talk Nodes, ensuring that the network remains operational and incentivized.

- Referrals: Driving Network Engagement

• Referral Fees allow immediate referrers to earn 10%, while 5% goes to second-tier referrers, promoting user acquisition and ecosystem expansion.

- Project Affiliation Fees: Pushing B2B2C model on L1X-Swap

• Project Affiliation Fees are configurable by projects and they allow the projects to provide bridgeless and no-wallet connect based Direct Swap to the community members. These fees are based on a fixed % of the source amount of the swap (defined by each project).

The Tokenomics-Driven Burn Mechanism

The L1X tokenomics is intentionally designed to align every fee and transaction with value generation for token holders. By integrating a burn mechanism into multiple streams—Base Fees, Direct Swap Surcharge, and NFT Tier Sales—the system ensures a continuous reduction in token supply. This scarcity dynamic directly correlates with price appreciation, benefitting all participants in the ecosystem.

Incentivising Swaps for Long-Term Sustainability

The core objective of the L1X Fee Structure is to create a perpetual cycle of value creation and growth:

• More swaps generate more fees.

• Fees fuel the burn mechanism and incentivize stakeholders.

• The reduced supply drives token value, attracting more participants and increasing swap volumes.

This virtuous cycle reinforces itself, making L1X a resilient and growth-oriented ecosystem for cross-chain transactions. As the swap count and volume increase, the value of the L1X token grows proportionally, ensuring a thriving environment for users, developers, and token holders alike.

Ready for the Future

With its fee structure, L1X i is a forward-looking tokenomics-ready platform designed to reward participation, fuel growth, and maintain sustainability. Whether you’re an investor, liquidity provider, or NFT holder, every action you take contributes to the network’s success—and your own.