Overview

The L1X Foundation (L1X Stiftung) is thrilled to announce a Token Entitlement Issue, aiming to raise US$2,000,000 through the sale of L1X Coins at an issue price of $0.01 per coin. In addition, the Foundation has secured an underwriting commitment of US$1,000,000 to ensure that ongoing essential funding needs are met.

The investors with Rights Issue will be allocated the coins directly upon investment with no cliff and vesting and will be classified as Category A in the Release Pool upon DeX Listing at a target price of US$0.15. More info on the Release Pool here.

Use of Funds

Funds raised through this Token Entitlement Issue will be strategically applied to support the growth of L1X and its ecosystem:

- Liquidity Pools: Establishing liquidity pools to support cross-chain transactions and earn protocol fees.

- Business Development: Expanding our market presence and promoting our cross-chain swap technology to DeFi aggregators, exchanges, dApps, launchpads, and marketplaces.

- Cross-Chain Swap Maintenance: Ongoing development and maintenance of our cross-chain swap application.

- Operational Expenses: Supporting the operational requirements essential for sustainable growth.

About Layer One X (L1X)

Layer One X (L1X) is a decentralized Layer One blockchain built to empower developers to create multi-chain decentralized applications (dApps). L1X addresses the limitations of traditional blockchains, such as high transaction fees, slow transaction speeds, and limited cross-chain capabilities. Its proprietary X-Talk technology enables seamless interaction between various blockchains, including EVM and non-EVM chains.

Market Opportunity – Cross-Chain Swap Marketplace

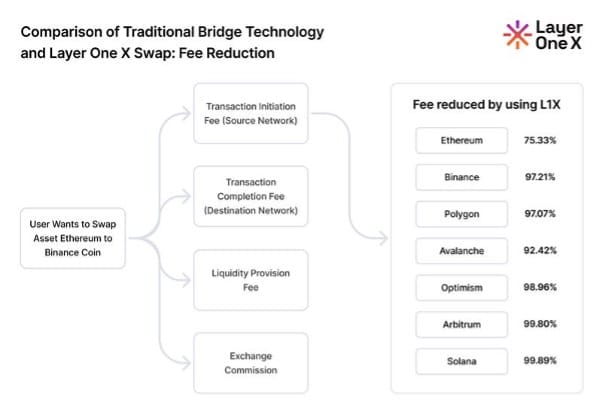

The cross-chain swap market has grown rapidly, transaction volumes have increased from $0.8 billion to $200 billion in 2024, and are projected to reach $1 trillion by 2026. Current fees for cross-chain transactions range from $0.35 to $5 due to the fragmentation among solution providers. L1X addresses this fragmentation gap with a B2B solution that delivers faster, safer and more affordable cross-chain swaps. By reducing integration time from 30 days to just 7 days, L1X is positioned to become a market leader, enabling seamless transactions across blockchain networks.

Key Highlights

Security remains a primary concern in cross-chain technology, with over $3 billion lost in hacks over the past three years. Layer One X has developed a secure, innovative cross-chain swap solution, having processed over 75,000 transactions to date, without any security incidents. Independent audits from reputable code audit groups confirm the safety of L1X’s protocol, making it a trusted choice for secure cross-chain operations.

L1X’s technology also offers significant cost savings and ease of integration, giving dApp developers an efficient and economical way to handle cross-chain transactions. This innovation allows applications to incorporate L1X’s infrastructure for substantial fee reduction, enhanced security, and reliable transaction tracking.

About X-Talk Technology

At the core of L1X’s cross-chain functionality is X-Talk, a proprietary interoperability solution that connects blockchain networks without relying on traditional bridge mechanisms.

- Native and Multi-Chain Connectivity: X-Talk supports seamless communication between different blockchain networks, enabling native (within L1X) and multi-chain interactions.

- Decentralized Architecture: X-Talk’s decentralized structure allows direct asset and smart contract exchanges across chains without intermediaries, minimizing security risks.

- Payload Modification: Unlike typical bridge solutions, X-Talk enables the modification of transaction payloads based on third-party conditions, ensuring compatibility with the destination chain.

- Enhanced Security: X-Talk includes a node scoring system that evaluates factors like stake balance, event accuracy, and processing time, reinforcing network reliability and security.

Through X-Talk, users can manage assets across chains, perform cross-chain staking, and even publish NFT sales across blockchain marketplaces. This versatile technology significantly reduces transaction complexity, costs, and time, positioning X-Talk as a game-changer in the cross-chain market.

Revenue Streams

The L1X protocol generates revenue from two main sources:

- Protocol-based Transactions: Fees collected from applications directly built on the L1X protocol.

- Swap Technology Usage: Fees earned from L1X’s cross-chain swap technology, which allows assets to move seamlessly across different networks.

This technology has broad applications across multiple sectors, such as DeFi, logistics, supply chain, and healthcare, reinforcing L1X’s role in the cross-chain market. By tapping into a $200 billion (2024) market, L1X is positioned for substantial growth as more industries adopt cross-chain interoperability.

Read more on the L1X Protocol Roadmap

Impact of Swap Growth on L1X Coin Demand

As L1X’s cross-chain swap service expands, the demand for L1X Coins is anticipated to increase. Each transaction on the network relies on L1X Coins to leverage the X-Talk infrastructure, which includes monitoring events from the source chain, validating payloads, and executing seamless transactions on the destination chain. This utility directly correlates with L1X Coin demand, benefiting from the growth in swap volumes as more DeFi applications and blockchain platforms adopt L1X’s cross-chain solution.

The increase in transaction throughput not only strengthens the utility of L1X Coins but also enhances liquidity and adoption within the ecosystem, driving price stability and growth. L1X’s infrastructure is essential for the future of cross-chain operations, and the expanding swap ecosystem supports a promising demand trajectory for L1X Coins.

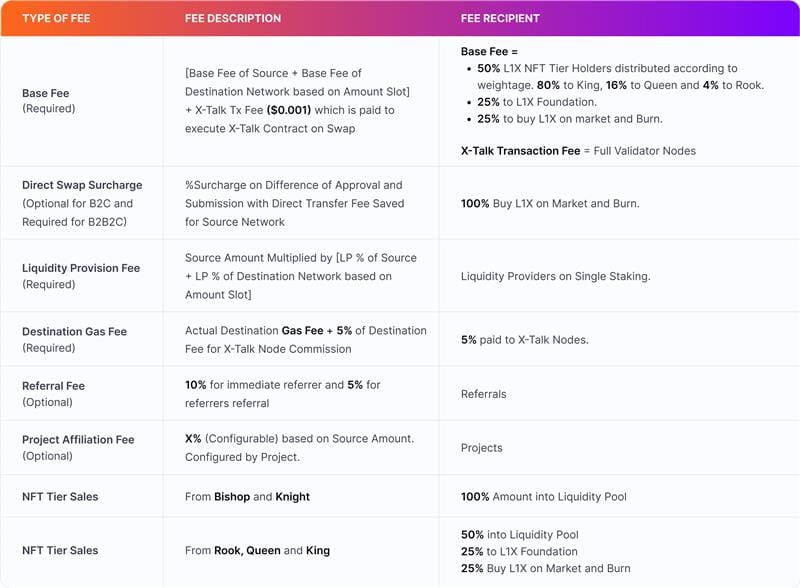

L1X-Swap Fee and its impact on price of the Coin

A virtuous cycle to increase swap count and volume, which directly correlates with the coin’s price, has been implemented. The L1X fee structure is designed to promote a chain of recipients, leading to more swaps in a continuous cycle. To establish a burn mechanism for the coin:

• 25% of the Base Fee,

• 100% of the Direct Swap Surcharge, and

• 25% of NFT Tier Sales (from Rook, Queen, and King tiers)

...are allocated towards purchasing L1X coins from the market and burning them.

Token Entitlement Offer Details

- Max L1X Coin Supply: 1,000,000,000

- Coins in Circulation (as of 1/11/2024): 30,839,512

- New Coins to Issue: 200,000,000 at $0.01 each

- Goal: Raise $2,000,000

- Total Coins Post-Issue: 230,839,512

- Offer Start Date: 09/11/2024

- Offer End Date: 07/01/2025

Underwriting Commitment

The L1X Foundation has secured an underwriting commitment of US$1 million for the Token Entitlement Issue. This commitment ensures that, in the event the community does not fully subscribe, the underwriters will purchase the remaining L1X Coins. This financial backing guarantees that critical funding for liquidity, marketing, and operational expenses will be met. The underwriters, comprised of reputable institutional investors, underscore their confidence in L1X’s mission and its growth potential in the cross-chain swap market.

How to Participate

You can swap into L1X with your wallet address that you previously registered with in the previous sale. Visit L1XApp Swap Page to participate in the rights Issue.

Join the L1X Community

Don’t miss this unique opportunity to be a part of L1X’s journey in revolutionizing cross-chain swaps. Join us on Discord or Telegram for live updates, community discussions, and support. Be part of the future of decentralized cross-chain transactions!