Liquidity is the lifeblood of decentralized exchanges (DEXs). Yet most new projects launch with dangerously low liquidity, creating high slippage, poor user experience, and a rapid collapse in trading activity.

Quantum DeX is changing this with its AI-powered Smart Liquidity Model giving projects instant bootstrap liquidity, protecting users against rug pulls, and ensuring pools remain deep and credible from day one.

📉 The Liquidity Crisis

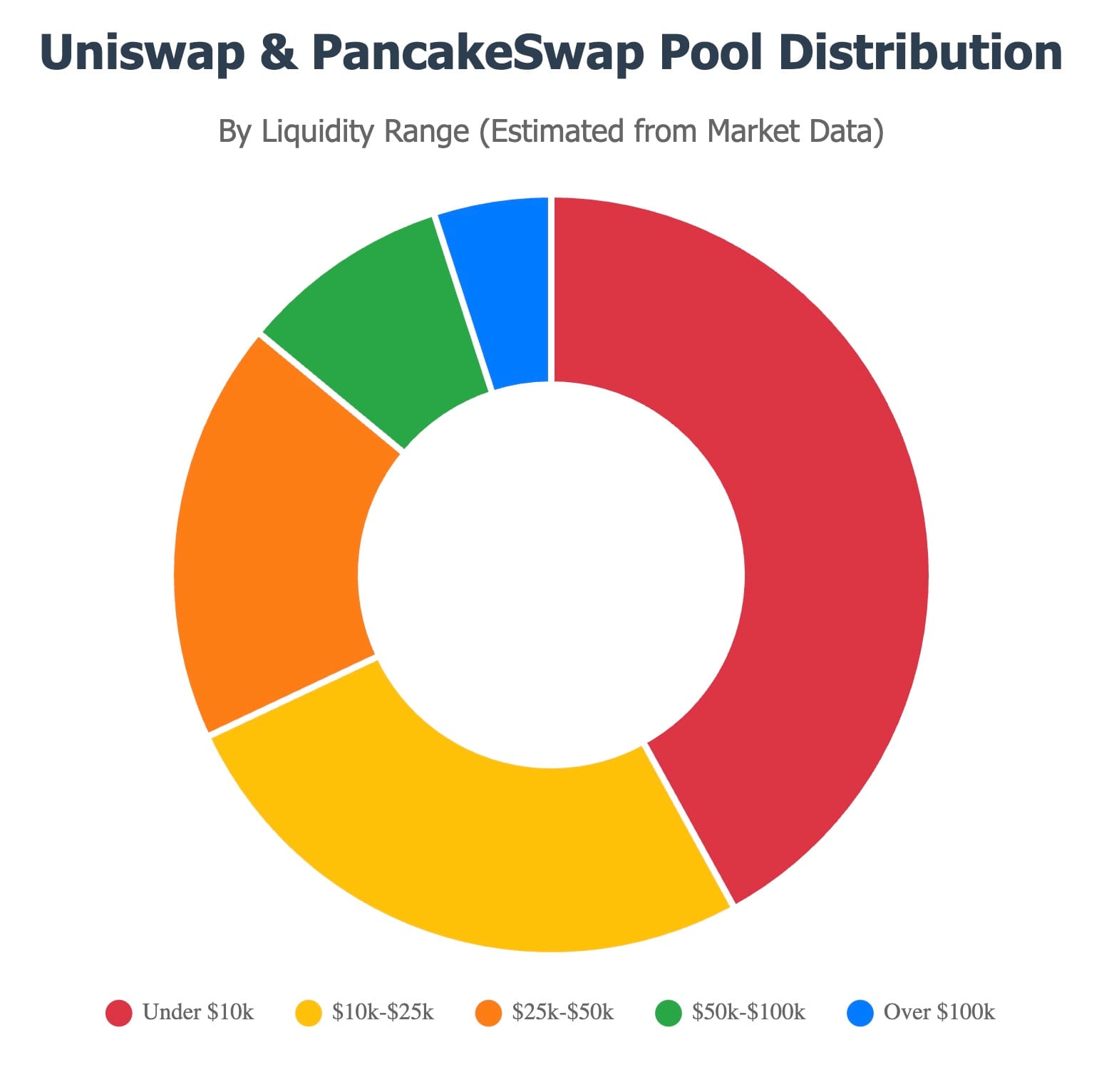

1. Pool Distribution Problem

Most pools on Uniswap and PancakeSwap launch weak:

- 68% have less than $25k liquidity.

- 40% start with under $10k.

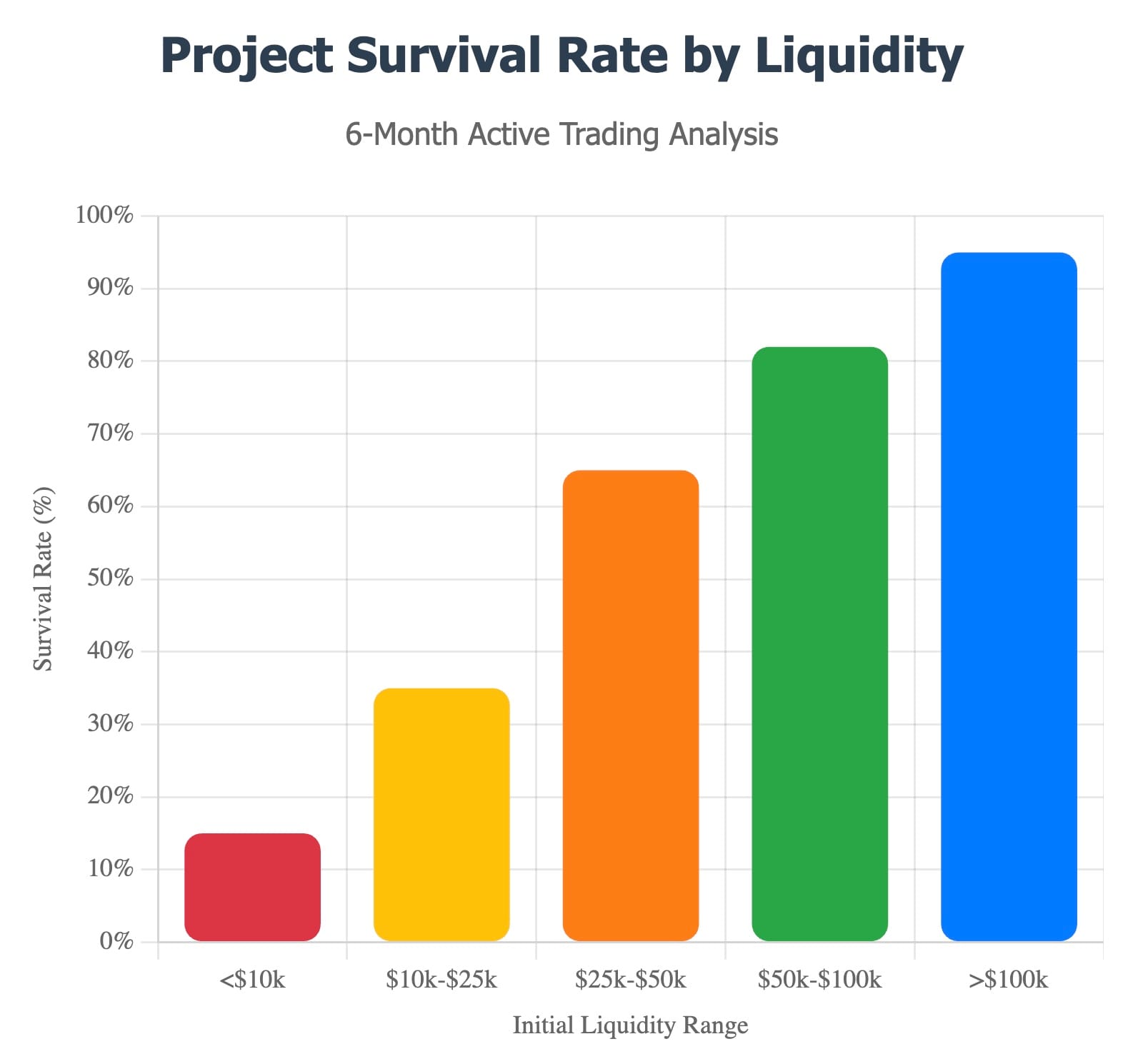

2. Survival Rates Collapse

Liquidity directly impacts survival:

- < $10k liquidity → 15% survive 6 months.

$100k liquidity → 95% survive 6 months.

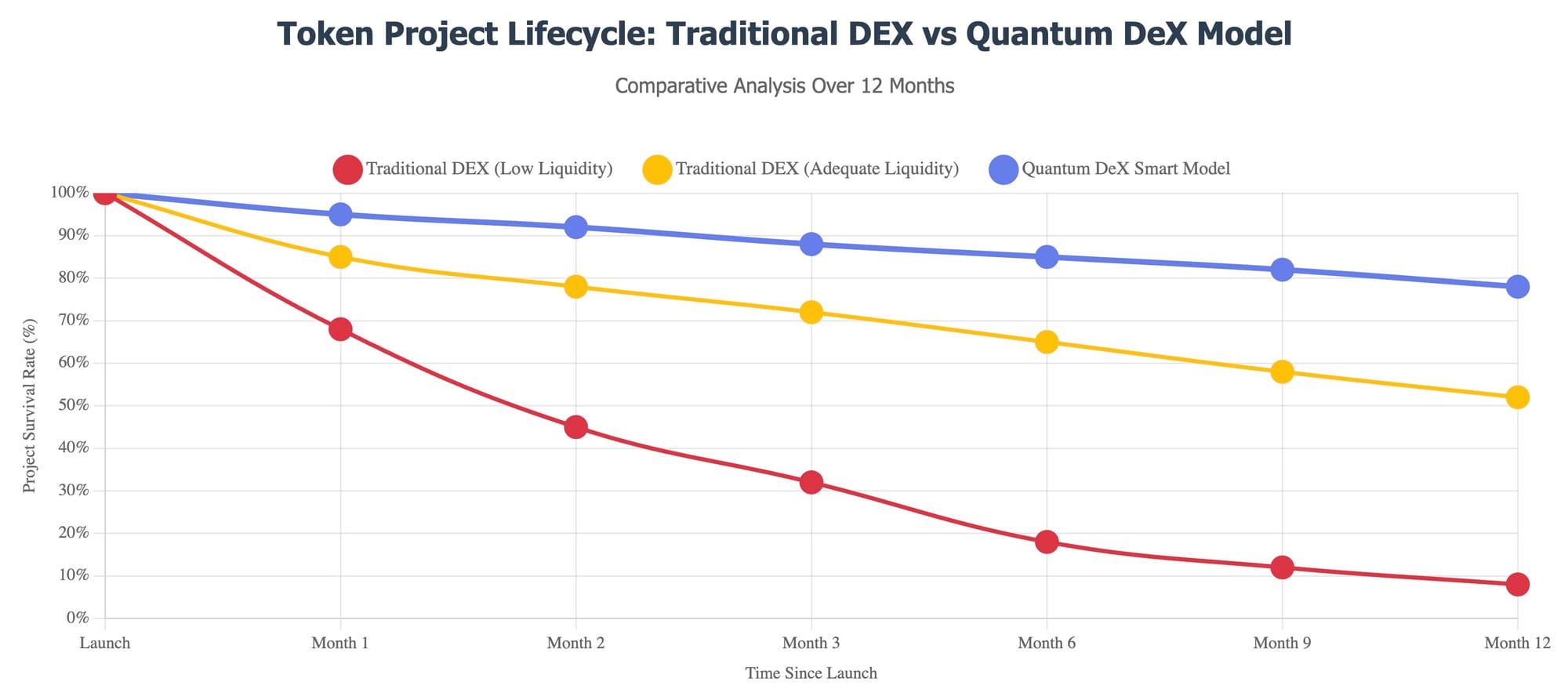

3. Death Spiral Effect

- High slippage (>5%) makes trading unattractive.

- Lower trading volume reduces liquidity further.

- Projects spiral to failure.

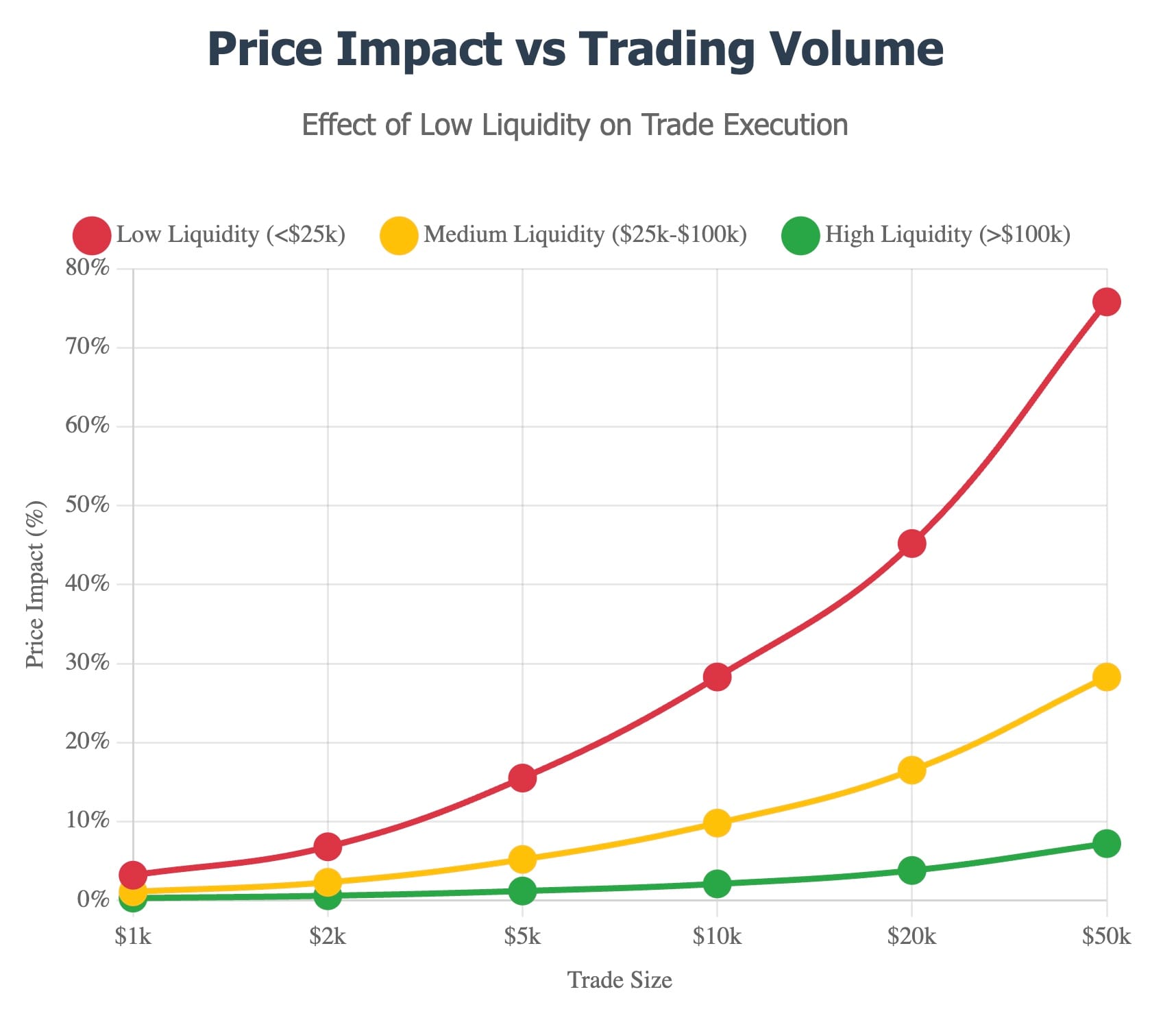

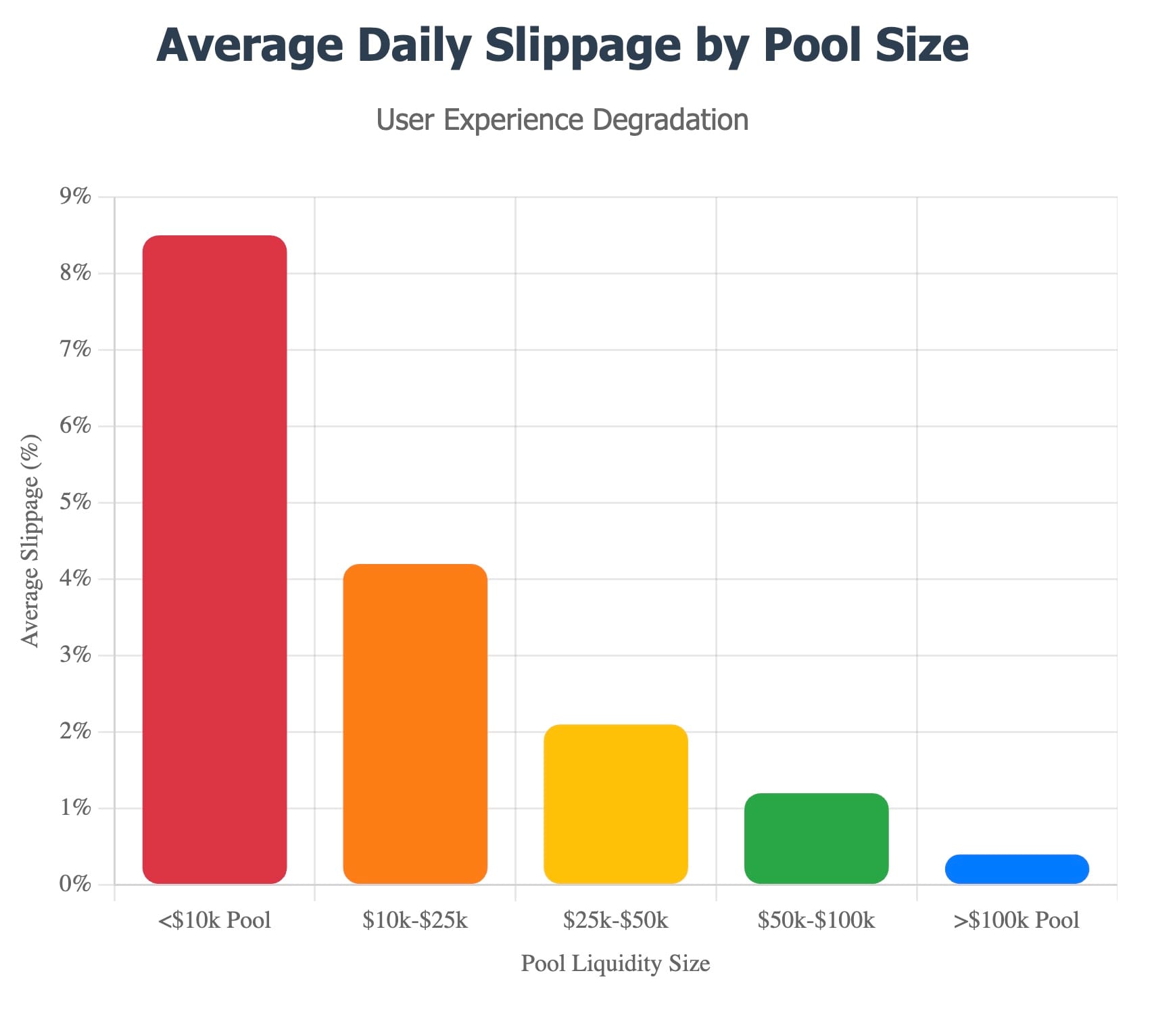

⚠️ The Hidden Costs of Low Liquidity

- Price Impact: A $5k trade in <$25k pool can cause >10% slippage.

- Slippage: Pools under $10k average 8% slippage per trade.

- User Abandonment: High spreads drive away traders, killing growth.

💡 The Quantum DeX Advantage

Quantum DeX tackles these problems head-on with its Dual-Layer Liquidity Model and AI-driven controls:

- Protected Base Liquidity (WL1X Loan Funds)

- Bootstrap liquidity is locked for pricing integrity.

- Users cannot drain WL1X by swapping project tokens.

- ✅ Built-in rug protection.

- Free Market Liquidity

- Any additional WL1X is fully tradable.

- ✅ Users enjoy low slippage and deep pools.

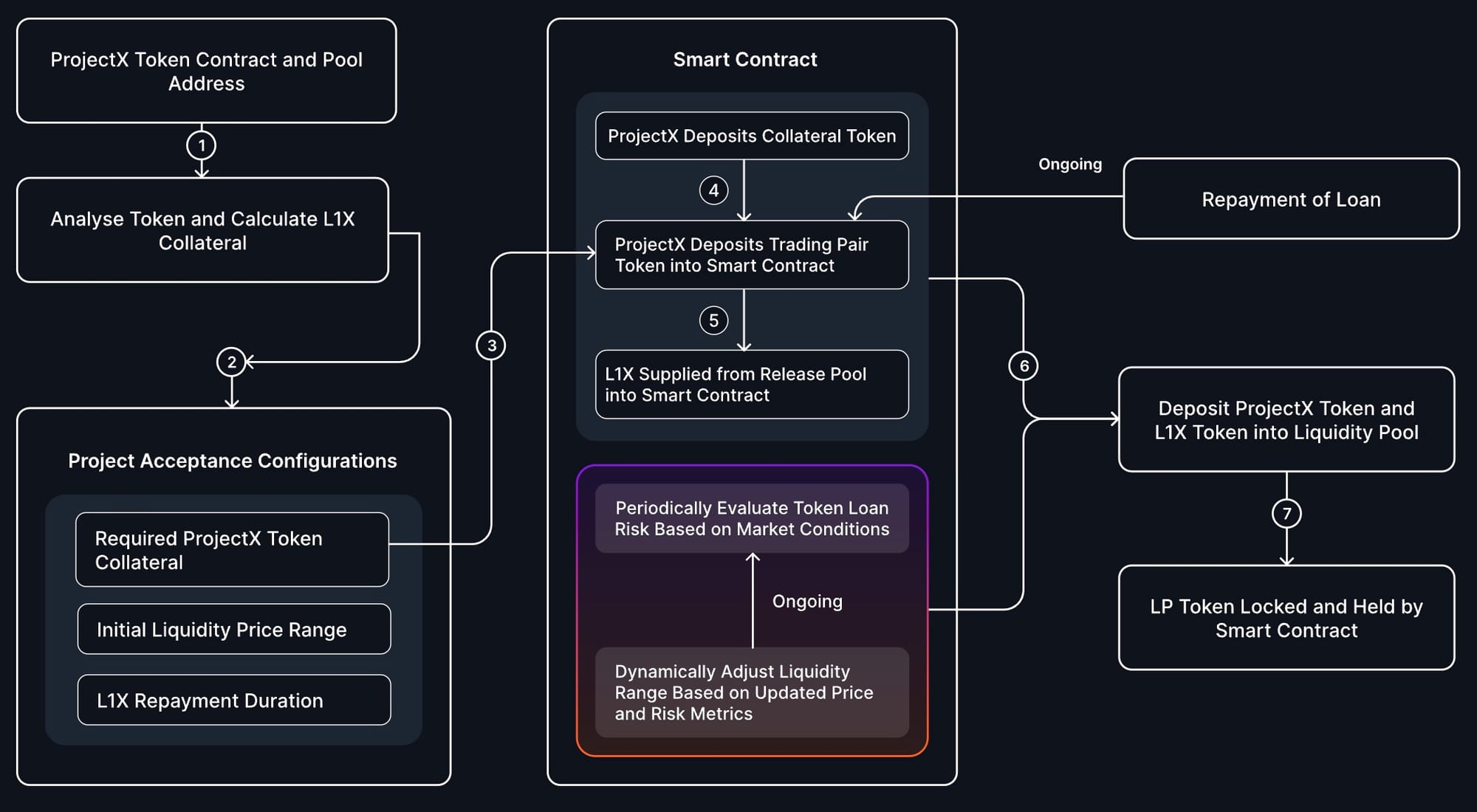

🔄 How It Works — Step by Step

- Mint Token – Project creates token on L1X.

- Confirm Loan Offer – AI sets collateral, loan terms, and repayment.

- Set Price & Launch Pool – Define token’s fair starting value.

- Deposit Collateral – Lock project tokens as security.

- Add Project Tokens + WL1X Loan – Bootstrap liquidity pool is created.

- Pool Live – Trading opens with anti-rug safeguards and low slippage.

- Repayment – Loan repaid over time; collateral released after repayment.

📊 Smart Liquidity in Action

- 3x Higher Survival Rate — Projects stay alive longer.

- 75% Less Slippage — Better user trading experience.

- $50k+ Effective Liquidity — Even for small projects.

- 24/7 Optimization — AI continuously rebalances liquidity ranges.

🌟 Why It Matters

- For Projects: Instant credibility, deeper pools, fairer launches.

- For Users: Safer trading, anti-rug protection, less slippage.

- For the Market: Sustainable liquidity = sustainable growth.

Quantum DeX doesn’t just launch tokens. It ensures they thrive.

👉 This is more than a DEX — it’s the future of fair token launches.