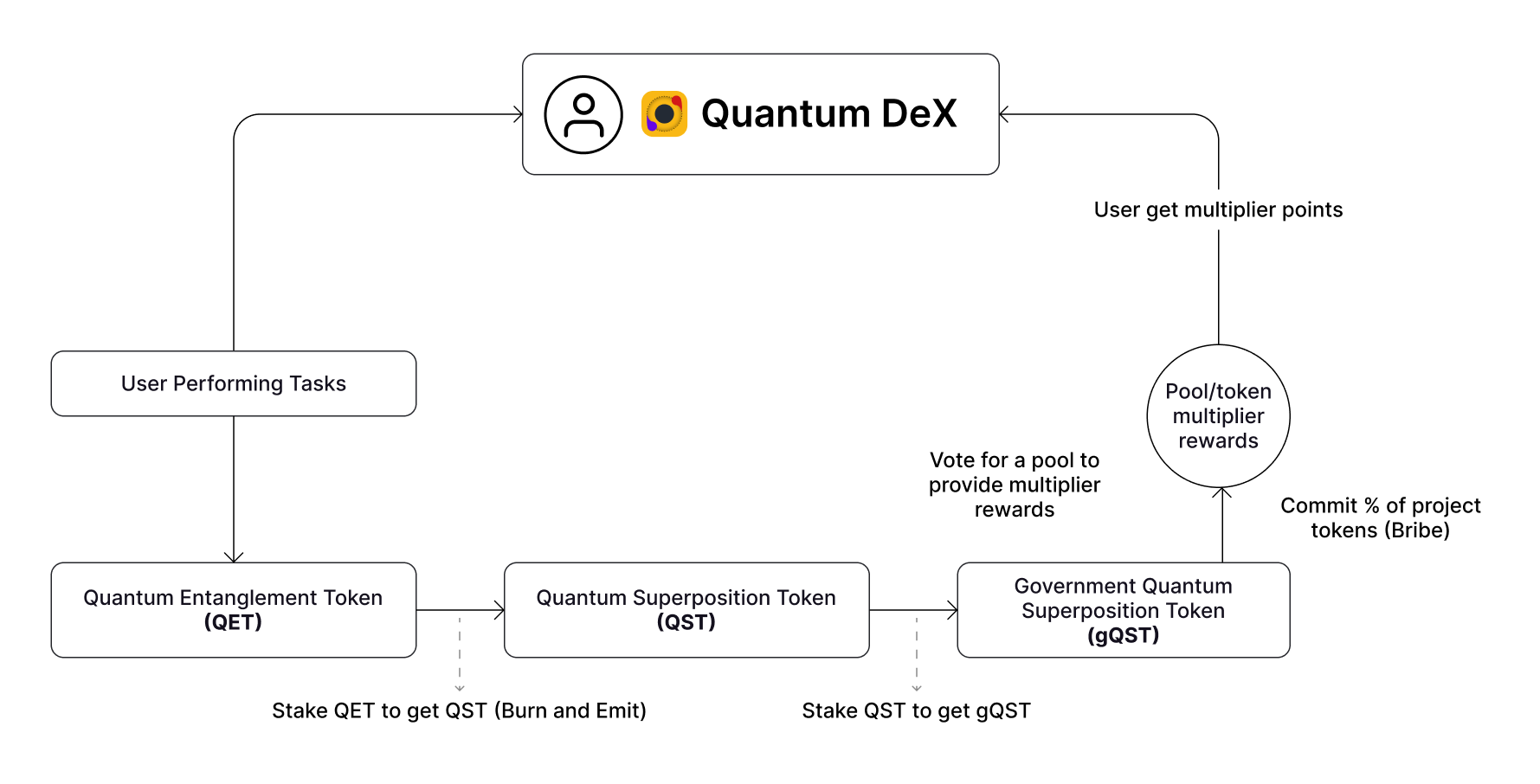

Quantum DeX employs an innovative dual-token model designed for sustainable growth and aligned incentives. The platform’s tokenomics revolve around two core tokens: Quantum Superposition Token (QST) which is the primary token – a fixed-supply governance and value accrual token, and Quantum Entanglement Token (QET) – a performance-based emission token minted in proportion to the DEX’s fee revenue. These tokens work in tandem to reward active participants, empower long-term governance, and ensure that emissions are backed by real protocol usage. The model takes inspiration from proven designs (Curve’s veCRV, Velodrome’s veVELO, Pendle’s vePENDLE), while introducing improvements in sustainability and incentive alignment.

Click here to visit Quantum DeX Website

Figure 1: Visual schematic of the Quantum DeX tokenomics model. Users earn QET through protocol activity and can stake (burn) QET to claim QST rewards. QST can be locked for gQST to earn fees, influence reward distribution (gauges) and participate in governance. External projects may also provide incentives (token incentives) to gQST voters to boost their pool’s multiplier rewards.

QST – Fixed-Supply Governance Token (Primary Token)

QST is the trade and value accrual token of Quantum DeX, with a fixed maximum supply of 100 million tokens. Unlike inflationary DEX tokens that dilute over time, QST has a hard cap, reinforcing long-term scarcity and aligning value capture with protocol growth. It plays a central role in Quantum DeX’s ecosystem by enabling governance, incentivizing participation, and capturing trading revenue from the protocol’s operations.

Holders of QST are encouraged to stake their tokens into gQST, which unlocks governance rights and access to protocol rewards known as interface fees which is collected on every trade that happens on Quantum DeX. The gQST mechanism incentivizes long-term alignment and active contribution to the protocol’s future. As Quantum DeX grows, so does the utility and yield potential of gQST holders, creating a compounding value loop.

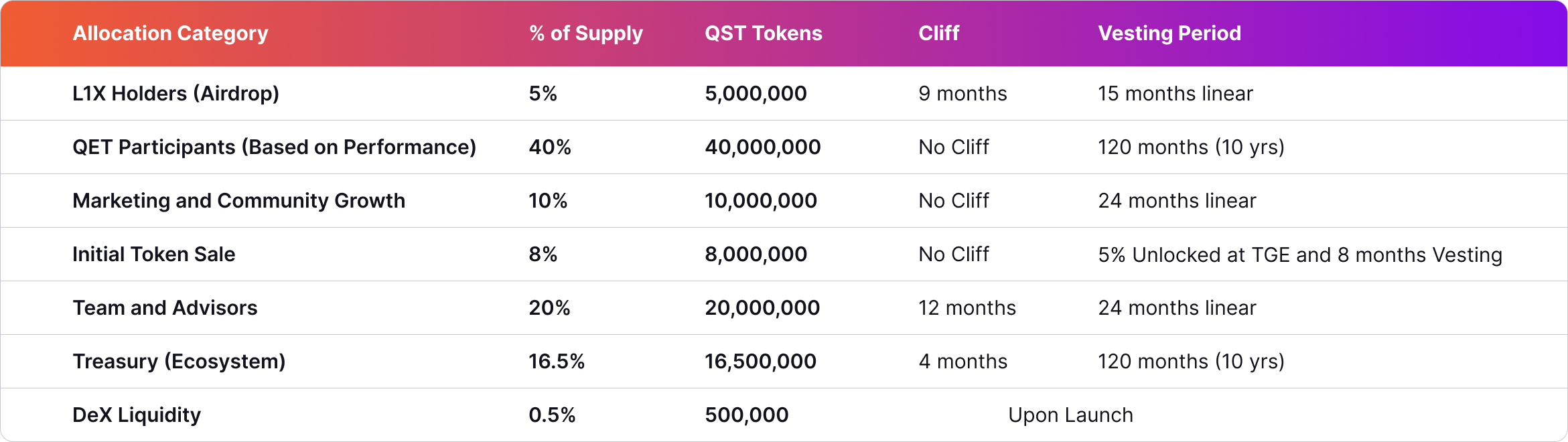

QST distribution is carefully designed to support protocol expansion, community alignment, and sustained liquidity growth, with tailored cliff and vesting schedules for each category. This ensures that early contributors, ecosystem builders, and strategic investors are all aligned with the long-term health of the protocol.

Table 1 shows the allocation breakdown of QST’s 100 million supply, including each category’s percentage, token amount, and vesting schedule (cliffs and vesting periods):

gQST Value Capture

QST can be staked for gQST (governance QST), unlocking both decision making power and protocol revenue share. A portion of trading fees collected by Quantum DeX are allocated to gQST holders, either directly as rewards or indirectly via buybacks, liquidity reinforcement, or yield mechanisms.

In addition to trading fees, gQST holders play a critical role in directing QET emissions (Quantum DeX’s reward token) toward specific liquidity pools. This makes gQST a governance throttle for protocol incentives, similar to veCRV’s gauge based system. Projects listing on Quantum DeX must bribe gQST holders with incentives, often in the form of their own tokens, USDT, or other valuable assets, in order to attract QET emissions to their pools.

This creates a new yield layer where gQST holders can earn project tokens, stablecoins, or governance assets simply by voting for where QET rewards should go. Over time, this transforms gQST from a passive governance asset into a powerful income stream generator tied directly to the protocol’s activity and listing ecosystem. As Quantum DeX attracts more projects, bribe driven pool competition increases, and gQST holders benefit from both increasing protocol revenue and an expanding portfolio of third party token incentives.

The longer users lock their QST into gQST, the more voting power and fee share they earn, incentivizing long term participation over short term speculation and embedding gQST into the protocol’s economic and governance core.

QET – Performance-Based Emission Token

QET (Quantum Entanglement Token) is the dynamic rewards token emitted by Quantum DeX in response to protocol activity. It has a performance-based supply: QET is minted in proportion to the DEX’s fee revenue and serves as the instrument by which users earn QST. Importantly, QET is not meant to be a long-term value-holder; instead, it functions as a transient rewards medium (often immediately staked/burned to claim QST). This dual-token approach separates the governance/value token (Staked QST) from the rewards mechanism (QET), preventing excessive sell pressure on the main token and tying emissions to actual usage (“real yield”).

Minting QET from Fees: Each epoch (weekly, in this model), Quantum DeX mints new QET tokens based on the trading fees collected. A predetermined percentage of weekly fees – for example, 20% of all protocol fees – is allocated to the rewards pool. From this pool, an equivalent value of QET is minted. In formula terms:

• Let F = total fees collected in a week (in USD value).

• Let r = reward allocation percentage (e.g. 20% or 0.20).

• Let P = reference price for minting QET (QST’s current price).

QET_minted = F * r / P

For example, if in Week 1 the DEX generates $100,000 in fees and the rewards allocation r = 20%, then $20,000 worth of QET is minted for that week. If we assume a $1 reference (P = $1 per QET at mint time), this results in 20,000 QET newly created for Week 1. The QET mint rate thus auto-scales with performance – higher trading volume directly increases rewards, while in low activity periods fewer tokens are minted, ensuring the protocol isn’t overpaying when usage is low.

Distributing QET to Users: The newly minted QET tokens are distributed to users based on their contribution to the protocol’s activity during that epoch. Quantum DeX incentivizes a range of actions – for instance: providing liquidity to pools, executing swaps (trading), possibly even actions like staking or referring users. Users who generate fees for the protocol thereby earn QET rewards proportionally. This can be envisioned as a “liquidity mining 2.0”, where both liquidity providers and traders (and other participants) earn QET for driving the DEX’s success. The distribution model might allocate QET along lines such as: X% to liquidity mining (split across pools according to liquidity gauges/votes), Y% to traders as a volume rebate, etc., but all stemming from that week’s mint. In short, the more value a user brings to the platform (in trading fees or liquidity depth), the more QET they earn.

Staking (Burning) QET for QST Rewards: QET’s ultimate purpose is to be converted into QST, the governance token. Quantum DeX implements a weekly QST reward pool (emission pool) from which QST is distributed to users who stake (effectively burn) their QET. Staking QET destroys the QET token and grants the user a share of that week’s QST emissions. This design links QST emissions to actual usage while keeping QST supply growth under control.

The key mechanics are:

• Fixed Weekly QST Emission: From the QST allocation for QET participants (50 million QST over 10 years), a fixed amount of QST is released each epoch. If distribution is linear, this would be roughly 50,000,000 / (10 years × 52 weeks) ≈ 96,150 QST per week (this number could be adjusted or front-loaded, but for illustration we’ll assume a constant weekly emission). The weekly QST emission pool is denoted as E_week. In our example scenarios below, we use a smaller number (20,000 QST) for ease of calculation, but in reality it would be on the order of ~100k QST/week as per the 10-year schedule.

• Users Stake QET to Claim QST: At the end of each week, users can stake their earned QET tokens to claim a portion of that week’s QST emission E_week. Any QET staked in the epoch is burned in exchange for QST from the pool. The share of QST a user gets is simply proportional to their share of the total QET staked that week.

• Unstaked QET can be kept by users, but unstaked QET does not earn QST for that week’s pool. If a user delays staking their QET, they miss out on the current week’s QST distribution (but could stake in a subsequent week to get future emissions). This creates a strong incentive to stake QET immediately, as holding QET without staking has an opportunity cost (foregone QST rewards). Essentially, QET continuously loses value unless converted to QST, because each epoch’s QST rewards only go to those who stake.

Mathematically, if S_week = total QET staked in a given week, and E_week = total QST emitted that week, then each staker receives QST in proportion to their QET amount. The conversion rate (QST per QET) for that week can be expressed as:

QST_per_QET_week = E_week / S_week

Where:

· E_week = Total QST emitted in the week

· S_week = Total QET staked (burned) that week

This rate fluctuates based on participation. If fewer people stake QET based on a minimum amount of QET needed to stake (low S_week), then each QET earns more QST; if many stake (high S_week), each QET yields less QST. Importantly, any unused QST emissions will be locked in the treasury to carry forward or to burn based on the decision of the QST holders. In practice, it means early or active participants get a larger share of QST, bootstrapping the ecosystem with high initial rewards that taper naturally as more users join. This “fixed emission with performance gating” approach creates a self-balancing incentive: when participation is low, rewards per token are high (attracting more participants), and when participation is high, per-token reward is lower (preventing excessive token giveaway).

Overall, the QET mechanism ensures Quantum DeX only mints reward tokens when actual value is generated (fees), making it far more sustainable than models that emit a fixed number of tokens regardless of usage. It also cleverly uses fixed QST emissions to create variable APY – high when the protocol is quiet (to attract users) and moderate when the protocol is booming (since less incentive is needed). The QET token by design should have a transient life: users earn it and promptly stake it to get QST. Any QET that remains in circulation is essentially potential future governance token waiting to be claimed. By decoupling the reward token from the governance token, Quantum DeX avoids the problem many DEXes face where the governance token is constantly sold off by yield farmers; instead, short-term farmers might sell QET (which could have a market value reflecting expected QST conversion), but long-term believers will acquire and stake QET to obtain QST – thus concentrating QST in the hands of active participants.

gQST – Governance Locking and Emission Control

To participate in governance and direct the protocol’s liquidity incentives, QST holders are encouraged to lock their QST for a fixed duration. Locking QST yields gQST (governance Quantum Superposition Token), a non-transferrable representation of voting power in the system. This mechanism is akin to Curve’s veCRV or Velodrome’s veVELO, but Quantum DeX’s design uses a fixed, non-decaying model.

Locking QST for gQST: When a user locks their QST, they choose a lock duration between a minimum and maximum (with 208 weeks, i.e., 4 years, being the maximum lock period in this model). The amount of gQST received is proportional to both the amount of QST locked and the length of the lock. Specifically:

gQST = QST_locked × (lock_weeks ÷ 208)

This means:

• Locking the maximum 208 weeks (4 years) grants 1 gQST per 1 QST locked (full voting weight).

• Shorter locks yield proportionally less. Example: Locking for 104 weeks (2 years) gives 0.5 gQST per 1 QST; locking for 52 weeks (1 year) gives 0.25 gQST per QST, and so on. (E.g., 1,000 QST locked for 1 year results in 250 gQST.)

Crucially, gQST does not decay over time during the lock period. In many ve-token models (like veCRV), a user’s voting power gradually declines as their lock approaches expiry. In Quantum DeX, once gQST is assigned at lock time, that gQST remains constant for the entire lock duration. The user enjoys full voting power that entire period, only losing it when the lock expires (at which point the QST can be withdrawn and the gQST is effectively burned). This non-linear locking approach simplifies governance (no need to constantly extend locks to maintain power) and rewards users who commit early with sustained influence. For example, if Alice locks QST for 4 years, she has 100% of the possible voting weight from day 1 and keeps it until day 1460 (when her lock ends). Bob, who locks the same amount for 1 year, gets 25% of Alice’s voting power; even as time passes, Alice’s voting power does not decrease relative to others until her lock ends. To retain voting power after lock expiry, a user would need to re-lock their QST (potentially they can extend locks before expiry to avoid lapse, depending on contract implementation).

Using gQST – Governance and Gauge Voting: gQST holders have two primary utilities:

1. Governance Voting: gQST represents voting power in protocol governance decisions (proposals, parameter changes, upgrades, etc.). This ensures that only long-term aligned participants (those who locked tokens) can influence critical decisions, enhancing governance integrity.

2. Gauge Weight Voting (Multiplier Points Allocation – MP)

gQST gives holders the ability to vote on which liquidity pools receive Multiplier Points (MP) — a system used to amplify QET emissions for users who perform certain incentivized actions (e.g., swapping, LPing, staking) in those pools.

Each week, gQST holders can vote to allocate MP across pools. These votes do not directly assign emissions but influence the multiplier applied to a user’s QET rewards when they interact with that pool. Pools with more MP offer higher QET yield for the same action, making them more attractive to users.

In essence: gQST doesn’t control how much QET is emitted globally — it controls where QET gets enhanced via multiplier-based incentives.

This mechanism also supports bribe markets:

Projects can offer bribes (in their own tokens or stablecoins) to gQST holders in exchange for votes toward their pool. For example, Project XYZ may want higher MP on the XYZ/ETH pool and offer $50,000 worth of XYZ tokens to incentivize gQST voters. Voters who direct their gQST weight to XYZ/ETH will earn a portion of the bribe proportional to their voting weight.

This creates a virtuous cycle:

- Projects get more user engagement and deeper liquidity via boosted rewards.

- Users (gQST holders) earn bribes plus protocol fees.

- The DEX attracts more organic activity without inflating base emissions.

This model is distinct from basic emissions — it’s layered, where base emissions remain fixed, and MP+bribes help direct and optimize where those emissions generate the most value.

To make the gQST concept clear, Table 2 provides examples of gQST outcomes for various lock scenarios:

Table 2: Examples of gQST obtained from locking QST. Longer locks and larger amounts yield more gQST linearly. Voting power is proportional to gQST; for instance, if 1,000 gQST is considered 100% reference power in these examples, then 500 gQST is 50%, 125 gQST is 12.5%, etc. Non-decaying means these values remain constant through the lock duration (until unlock). A user who initially locks 1,000 QST for 4 years will always have 1,000 gQST voting power during those 4 years, whereas someone who locks 1,000 QST for 1 year stays at 250 gQST throughout that year.

Governance Integrity and Security: The combination of long-term locking and broad distribution of QST enhances the security and integrity of Quantum DeX’s governance:

• Since 50% of QST is distributed to QET participants over time, active users become the majority stakeholders. This mitigates centralization – no single early investor or team wallet can dominate voting, especially given vesting schedules.

• Required long locks for full voting power discourage short-term speculation in governance. Malicious actors would have to acquire and lock large amounts of QST for years to influence the system, which is economically risky and aligns their interest with the protocol’s success (due to the time commitment).

• The fixed-supply nature of QST means governance power is a zero-sum game (unlike inflationary systems where new token minting can dilute current voters). Early adopters and consistent participants will hold significant sway, which is by design – they earned it by contributing to the DEX’s growth or committing to locks. At the same time, no continuous inflation means the protocol cannot be “bought out” cheaply via endless token farming – one must buy existing QST from the market or earn it through QET, both of which reflect real value.

Finally, gQST holders are to be the recipients of protocol fee dividends. In many models, fees collected from trading are split entirely or partially to governance token lockers. Quantum DeX could allocate, say, a portion of the remaining 80% fees (after 20% to QET rewards) to gQST holders. This means gQST holders might regularly earn platform fees (in e.g. ETH or stablecoins) based on their gQST share, providing direct passive income and incentivizing more QST locking. Such fee sharing, combined with incentives and the prospect of QST price appreciation, makes holding gQST attractive – it’s not just a symbolic vote, but a financial stake in the DEX’s success.

In conclusion, Quantum DeX’s tokenomics paper outlines a holistic and well-calibrated system. The combination of a fixed-supply governance token (QST) with slow, vested release and a performance-coupled reward token (QET) sets the stage for a DEX that can incentivize growth without sacrificing long-term viability. Mathematically, it aligns reward output with fee input, maintaining an economically sound loop. Structurally, it improves on models like Curve and Velodrome by avoiding indefinite inflation and by simplifying user choices (earn-use-convert rather than hyper-financialized loops). For community members and token holders, understanding this model reveals how each component – QST allocation, QET emissions, gQST locking, and governance process – interlocks to drive sustainable liquidity, robust governance, and a true sharing of the DEX’s success. With Quantum DeX, users are not just traders or liquidity providers; they are stakeholders in a growing ecosystem, empowered to benefit from and contribute to the DEX’s evolution.