Welcome back, DeFi enthusiasts!

Let's dive straight into the exhilarating highlights of the recent L1X Multichain Balancer Pool launch event from the 21st of February 2024.

From exclusive insights to live Q&A sessions, we'll cover the key moments that defined this groundbreaking event. Join us as we revisit the excitement and innovation that marked the beginning of a new era in decentralized finance with L1X.

Remember Liquidity Boostrap Event is Now Live until March 5th with up to 600% APR Rewards.

Note: This is not Financial Advice. Do Your Own Research.

WATCH THE LIVE EVENT

Section 1. What is a Multichain Balancer Pool and Benefits?

Kevin highlighted the Multichain Balancer Pool's (MBP) role in aggregating assets across chains for optimized staking returns and efficient swaps. He emphasized the importance of DeFi pools and cross-chain interoperability in enhancing liquidity and operational efficiency. Kevin also outlined XTalk's solutions to technical challenges and explained the deposit process and transaction submission, stressing community understanding and potential for similar system development.

He highlighted how MBP addresses this by aggregating liquidity across protocols, akin to accessing index funds, thus mitigating inefficiencies caused by network disturbances.

Furthermore, Kevin emphasized the core offering of L1X: cross-chain interoperability. He explained how MBP facilitates the seamless transfer of assets and value across chains, unlocking unprecedented DeFi and passive income opportunities for users by leveraging each protocol's unique importance in the wider ecosystem.

Section 2. How a Multichain Balancer Pool Works?

Kevin outlined the streamlined process of utilizing the MBP through a flowchart, detailing steps such as depositing coins, determining price impact via L1X EVM, acquiring XBPT Tokens, adding liquidity, and interacting with L1X VM. He highlighted the seamless synchronization and efficiency achieved by L1X VM, contrasting it with bridges that rely on centralized information sources. Cost efficiency was emphasized, with transactions completed in a single step, enhancing user experience.

Addressing technical and operational challenges, Kevin mentioned X-Talk's solutions for cross-chain communication, smart contract compatibility, scalability, and security. He delved into the process of transferring coins using the Balancer protocol, emphasizing efficient interaction between L1X VM and EVM, optimized storage, and transaction execution speed. Additionally, it touched on MetaMask integration, pool compositions, rewards ratios, and values within the Balancer pools interface.

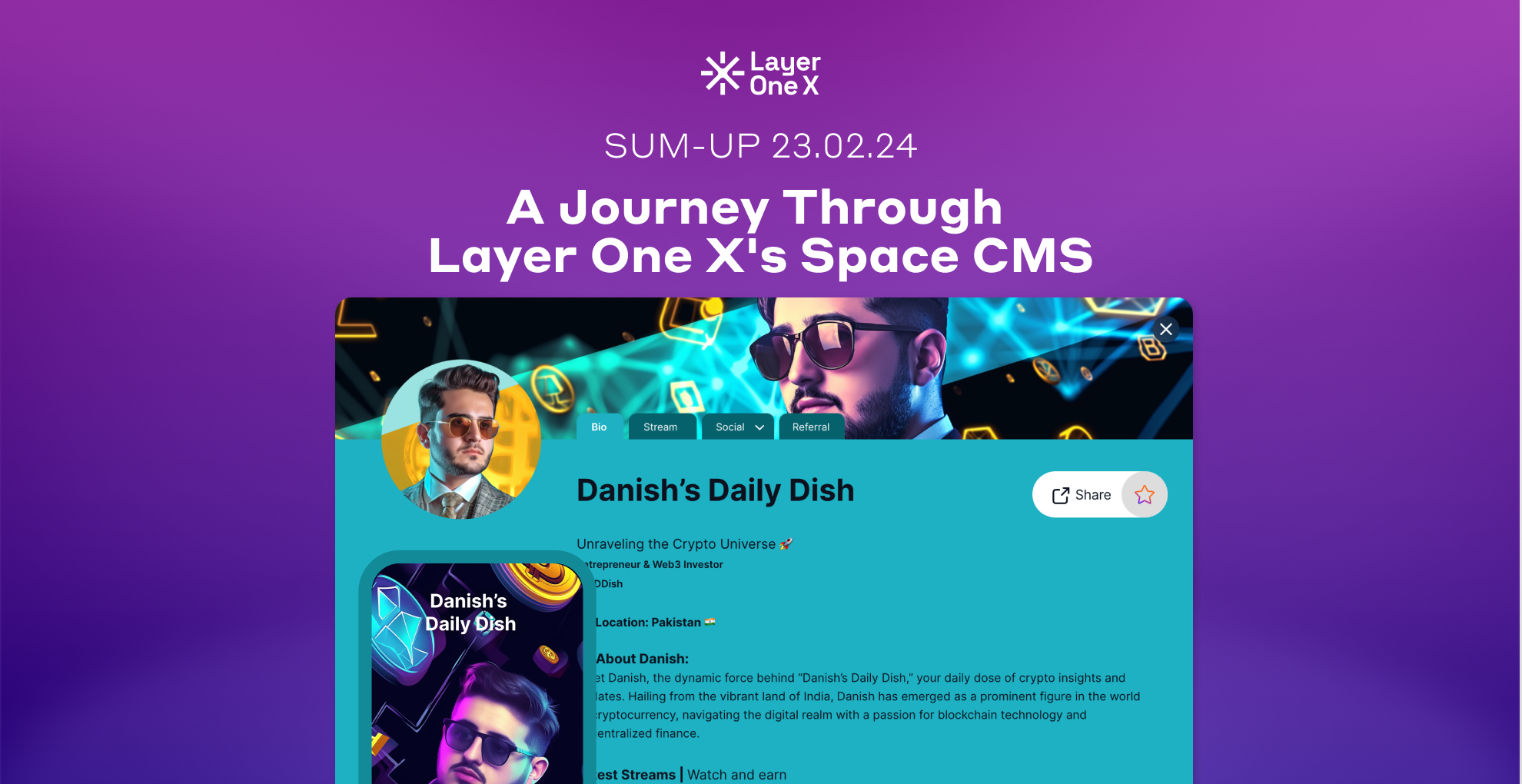

Section 3. Walkthrough of the Multichain Balancer Pool

Kevin discusses the process of receiving bonuses over time through deposits, which are airdropped daily to the wallet. He explains differences between XBPT received and XBPT tokens due to pre-deployment testing. Emphasizing data authenticity, He clarifies that numbers originate directly from the contract, not a database.

Demonstrating depositing into a pool, they preview bonuses and add liquidity, acknowledging potential Ethereum network delays. They introduce the assist desk for error assistance, simplifying error messages. They highlight checking transaction hash and receiving rewards every 24 hours.

Kevin demonstrates how to view assets in their wallet using v2 of XWallet, and how to send tokens to another account. Kevin also mentioned that they are working on integrating L1X network and XBPT tokens with MetaMask for better user experience. Kevin showcases how to configure L1X EVM with MetaMask and view native L1X coins in the wallet. This integration allows users to hold and view their tokens in MetaMask without needing to use the XWallet.

Section 4. Upcoming Roadmap

Kevin outlines the February roadmap, focusing on XBPT Token tradeability and daily emissions of L1X rewards coins to users' wallets.

Looking ahead to March, he discusses enabling Swaps, third-party liquidity pool creation, Bitcoin and Solana integration, and exploring multichain balancer pools for unique liquidity pairs. He also mentions liquid staking derivatives (LSD) and potential rewards for LP tokens paired with l1x across different chains.

Section 5. Deep Dive into Liquidity Staking Derivatives

Matiu explains LSDs using ETH and LIDO as an example. Users can swap ETH for stETH and create a Balancer pool with these derivatives, allowing swapping and selling. These derivatives aren't limited to Ethereum and can include tokens from multiple chains.

By issuing XBPT tokens from the pool, users can earn fees and rewards, usable in platforms like EigenLayer. Accessing multiple chains enables innovative financial products. The discussion highlights pool configurability, cross-chain trading, and liquidity benefits for less-traded tokens. It also mentions upcoming user-friendly tools for pool creation and troubleshooting token transfers via Metamask and XWallet.

Section 6. Gas Fees and Network Efficiency

Kevin discusses the low gas fees associated with token transfers on the L1X EVM, making transactions affordable even with varying token values. He emphasized the integration of MetaMask and the importance of having more Nodes for efficient transaction distribution.

Highlighting the speed and efficiency of L1X EVM nodes, he mentions the capability to handle 100,000 transactions per second with minimal fees, ideal for cross-chain transactions and smart contracts. Additionally, it is explained how cross-contract calls function and stress the importance of keeping transaction hashes in sync to prevent deadlocks.

Section 7. Cross-chain Swaps efficiency and Node Rewards

L1X maintains cost effectiveness despite Multichain Smart Contract interactions. They explain the flow of information validation and updating the registry using X-Talk and L1X VM technology. They emphasize the efficiency of building applications on this infrastructure and integrating wallets like L1X and Metamask simultaneously. It ishighlighted the usability of cross-chain swaps and multichain balancer pools for users. They stress the need to increase nodes for faster transaction processing and mention upcoming opportunities for hosting nodes and potential rewards for node operators. The plan is to release information on hosting nodes and associated costs and rewards in the near future.

Section 8. Benefits of Node Hosting

Kevin highlights the benefits of node hosting and updates on developing a simpler interface for it. He discussed the integration of the L1X network with Metamask for holding coins and tokens and emphasized reducing the need to switch between multiple wallets. Plans to open-source the XWallet are mentioned. Questions about TGE timing, security testing of the balancer app contracts, and L1X Foundation's involvement in liquidity bootstrap are addressed. Kevin and Matiu clarify that L1X is working with L1DEX to build a secure and comprehensive application.

Section 9. Why is Liquidity Bootstrapping Phase important right now?

It is important to showcase and test technology before the official launch, particularly in the pre-TGE phase, to demonstrate use cases and increase liquidity on swaps. Integration of other chains like Fantom is mentioned, with a focus on building liquidity on existing chains first, starting with BSC and ETH. The importance of common denominator tokens like USDT and USDC for liquidity pools is highlighted, along with the need for a common connector token for smooth transactions between different tokens across various chains.

Section 10. Conisderations for Integrating with different chains

Kevin examines major pools in Balancer across networks like Avalanche, Arbitrum, Ethereum, Optimism, and Polygon, analyzing volume-to-TVL and fees-to-volume ratios. Kevin notes low fees but suggest adding tokens like TRON to boost volume and adoption. X-Talk's potential to connect to any chain, like Cardano and Near, is highlighted, with emphasis on strategic chain selection.

Section 11. Why rigourous testing of L1X products is critical for success?

The community has a vital role in testing and reporting issues with the Multichain balancer pool for smoother adoption. Kevin and Matiu emphasize the project's novelty and complexity, urging thorough stress testing for errors. The discussion highlights the close relationship between blockchain communities and the opportunity for users to shape the project's evolution. The team plans to open swap transactions for community visibility, prioritizing user experience and technology.

The LIVE Event of the L1X Multichain Balancer Pool, was a comprehensive deep dive into the features, functionalities and roadmap of the Pool.

Stay updated on Discord and in our Social Media Channels and do not miss any News.

Summaries provided are brief overviews of associated YouTube videos. While we aim for accuracy, they may lack full context. For comprehensive understanding, watch the complete videos.